Reliance Jio not main reason for merger of Idea Cellular, Vodafone: Vittorio Colao

21 March, 2017 | Livemint

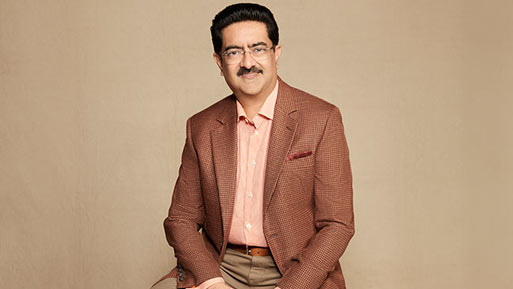

Share Kumar Mangalam Birla, chairman of the Aditya Birla Group of which Idea Cellular Ltd is a part, and Vodafone Plc chief executive Vittorio Colao spoke with reporters on Monday about how the merger of Idea Cellular and Vodafone India makes business sense. Edited excerpts:

Kumar Mangalam Birla, chairman of the Aditya Birla Group of which Idea Cellular Ltd is a part, and Vodafone Plc chief executive Vittorio Colao spoke with reporters on Monday about how the merger of Idea Cellular and Vodafone India makes business sense. Edited excerpts:

How do you sell this transaction to shareholders?

Birla: ...We believe that this is based on business fundamentals. So we got complementarity in assets in different markets. Vodafone is much more dominant in metros while Idea is quite strong in many rural markets. We would together have market share of about 40%. So I think it is the business logic that has fundamentally driven this combination and I believe that for us and for all other shareholders, this is something that c;reates immense value.

- Vodafone-Idea deal shows our commitment, say company heads

- We remain invested in a co of bigger size: Colao

- After Idea Cellular, Vodafone deal, Kumar Mangalam Birla, Vittorio Colao say ‘We see 5 players in long term’

- CNBC-TV18 Exclusive: Kumar Birla on why Idea, Vodafone merged

- Nothing is free, they (Reliance Jio) will have to charge sooner or later: Vittorio Colao, Vodafone Group PLC

There is a sense that the entry of Reliance Jio Infocomm Ltd has been one of the key factors driving the deal. Is that true?

Colao: You all talk about Jio. But the market leader is someone else and therefore it is not just about Jio. This is a very competitive market. We continue to be competitive. Now we are more sustainable because we are coming together and will be among the top two telecom companies in all Indian circles, except Jammu and Kashmir. We don’t have a single circle where we have below 10% market share, which means that you can make money in each circle and reinvest that in other circles. Our decision to merge has nothing to do with Jio. We have always said that India has been wonderful for Vodafone from a market point of view, from a customer point of view. I have been in conversation with Mr. Birla for many years and at some point we decided to come together. More than Jio or Airtel, I think it’s the arrival of data which is the key reason. Data, as you know, is very capital-intensive and requires a lot of spectrum.

When you first entered the country, India was described as the jewel in the crown for Vodafone Plc. Has it changed now?

Colao: India has been wonderful for Vodafone from a market, customer and brand point of view. But from a regulatory point of view, the price of spectrum has been very high. Hopefully the move c;reates better synergy.

Can this merger bring an end to the tariff war that the industry has been witnessing?

Birla: I don’t see any connect between the merger and the tariffs. We will still have five players in the market. We still remain a very intensely competitive market like in most parts of the world.

Going forward, do you see the regulatory environment as a major challenge?

Colao: I don’t think of regulators as a challenge; rather, regulation will help the industry develop. But with us coming together, the regulators have the real chance to prove that they are neutral.

We have heard that Vodafone is in talks to sell the excess stake and has reached out to a few potential buyers (according to the terms of the merger agreement, Vodafone has to bring its stake in the combined entity on par with that of Idea’s promoters, the Aditya Birla Group, by selling shares to it or to third parties)…

Colao: As I said, the merger has been on equal terms and at some point in time the shareholding of Vodafone will meet Idea’s stake. But there are no conversations about Vodafone selling its stake to anyone right now.