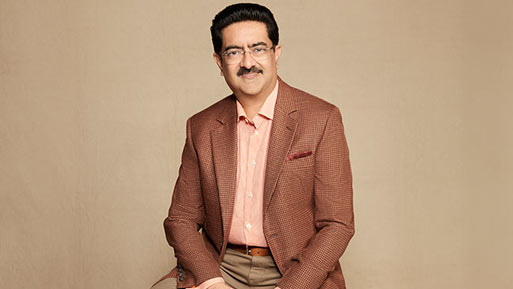

Aditya Birla Group to elevate D Muthukumaran as corporate strategy head

07 June, 2017 | The Economic Times

ShareHe will replace Saurabh Agrawal, who left to join Tata Sons as CFO; group likely to see more top-deck changes

Mumbai: Aditya Birla group will elevate former finance veteran D Muthukumaran as its head of corporate strategy to replace Saurabh Agrawal who resigned last month to join India's largest diversified conglomerate Tata Sons as its chief financial officer.

Muthukumaran, a trusted lieutenant of chairman Kumar Mangalam Birla and known in industry circles as Muthu, was shifted in 2014 to head the $41-billion group's private equity business. He will now be in charge of both corporate strategy and PE.

Muthu, who rose through the ranks in the group in his 15-year career, has been involved with the group's marquee acquisitions, including the acquisition of UltraTech Cement from L&;T in 2005, purchase of American aluminium can maker Novelis in 2007 for $6.5 billion and Carbon Black's buyout of Atlanta-based Columbian Chemicals Company for $875 million.

Moves in the C-Suite

D MUTHUKUMARAN

- Currently CEO at Aditya Birla Private Equity

- Previously was Head of Group Corporate Finance at the Group

Earlier Jobs

Corporate Finance at Lazard, and Deloitte

Education

Chartered Accountant

Big Deals Overseen

- Aluminium can maker Novelis in 2007 for $6.5 b by Hindalco

- Columbian Chemicals Company for $875 m by Carbon Black

- UltraTech Cement from L&;T in 2005

Muthu, an investment banker by profession, will work in the chairman's office with group chief financial officer Sushil Agarwal and corporate finance head Ashish Adukia.

"Muthukumaran has worked earlier in number of businesses, head of group corporate finance, has been part of several structuring and restructurings, acquisitions, including Novelis," the group's human resources head Santrupt Misra said. "He is familiar with most of the group businesses, large transactions and restructuring of the kind of the merger of Idea and Vodafone."

Muthu's predecessor Saurabh Agrawal joined Aditya Birla Group last year from Standard Chartered Bank with a mandate to restructure group businesses and explore opportunities to acquire companies in cement and mobile telephony.

In the past one year, he was involved with the merger of Idea with larger rival Vodafone India after India's richest businessman Mukesh Ambani launched Reliance Jio, purchase of 16 million tonnes of cement capacity from Jaiprakash Associates and was involved with the merger of Grasim and Aditya Birla Nuvo.

He will stay with the group until September. “Muthu is strong on strategic insights, financial understanding and legal issues," said Misra. "Therefore, he has been CEO of PE and when we had a vacancy and needed a seasoned player to take responsibility of Idea-Vodafone merger, he became as natural choice."

Misra also hinted some top deck reshuffle is on the cards after the merger of Aditya Birla Nuvo with Grasim and Idea and Vodafone.

"Nuvo-Grasim merger is already over...formal court approval has come through. Nothing much to be done. It is work in progress and will be done in 2-4 weeks," said Misra, who is also the managing director of Carbon Black business. "Some top deck changes will happen because Nuvo's chief financial officer will have to be placed in appropriate position....we have various options in mind and we will a take call soon."

"With the mergers there are several possibilities to shuffle, reshuffle and move people around...these are internal discussions," Misra added.