Aditya Birla Nuvo to merge with Grasim Industries

12 August, 2016 | The Hindu

ShareThe group will hive off its financial services business into a separate entity.

Aditya Birla Nuvo Ltd (ABNL) will merge with Grasim Industries Ltd in a bid to unlock shareholder value and c;reate a $9 billion (Rs 59,766 crore) enterprise. With the merger, the Aditya Birla Group decided to hive off its financial services business into a separate entity, which will be listed later.

The board of directors of Grasim Industries Ltd, ABNL and Aditya Birla Financial Services Ltd (ANFSL) at their respective meetings approved the merger of ABNL into Grasim and subsequent demerger and listing of the financial services business through a composite scheme of arrangement. The transaction which is subject to regulatory approvals would be implemented in two phases.

Win-win situation

First, ABNL would merge into Grasim and thereafter the financial services business would be demerged resulting in a listed financial services company with 57 per cent owned by post-merger Grasim and the balance being held by post-merger Grasim shareholders on a proportionate basis. Post-merger, Grasim, with an aggregate turnover of Rs.59,766 crore and EBITDA of Rs.11,961 crore for the year ended March 31, 2016, will become India’s top cement company and will be amongst the top 10 diversified private NBFCs in India. It will be the third-ranked telecom operator besides being among the top four private sector life insurance and asset management companies in India.

Combined entity

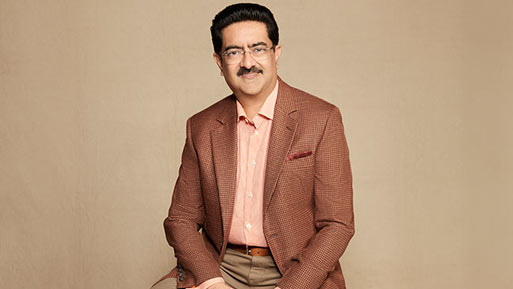

“The proposed transaction will c;reate a combined entity with $9 billion revenues, EBITDA of Rs 12,000 crore and EBIDTA margins of 19 per cent,” Kumar Mangalam Birla, Chairman, Aditya Birla Group told reporters. “It's a win-win for shareholders of both companies as Grasim shareholders will get access to high-growth businesses of financial services and telecommunications while Nuvo shareholders get strong cash flow business of cement and VSF.”

Idea Cellular

ABFSL will be listed by May-June 2017, Mr. Birla said. Mr. Birla denied reports that the merger was effected to give Idea Cellular access to strong cash flows ahead of the spectrum bidding process. “The Grasim stock had taken a beating because the structure of the deal that got reported was baseless. That the deal is done to fund Idea is not correct and it's like jumping the gun.” He said there will be no exposure to Idea's debt for the new merged entity.

Swap ratio

For the merger of ABNL with Grasim, each shareholder of ABNL will get three new equity shares of Grasim for every 10 equity shares held in ABNL which means a shareholder holding 100 shares in ANBL will receive 30 shares in Grasim. For the demerger of the financial services business into ABFSL, each shareholder of Grasim (post-merger) will receive seven equity shares in ABFSL for every one equity share held in Grasim which means a shareholder holding 100 shares in Grasim will receive 700 shares in ABFSL.

“In aggregate each shareholder of ABNL holding 100 shares will receive 30 shares in Grasim and 210 shares in ABFSL,” according to statement from the Aditya Birla Group. “With diverse businesses spanning manufacturing and services, the combined company provides a play on India’s growth story. The demerger and listing of the financial services will unlock value for shareholders,” Mr.Birla said.

Q4 target

The board of Grasim has also recommended sub-division of its equity shares of Rs.10 each into five equity shares of Rs. two each. The exchange ratio would be adjusted accordingly to take into account the effect of the sub-division. The transaction is expected to be completed by the fourth quarter of this year or in the first quarter of the next financial year. “The merger is creating a complex shareholding structure and is value disruptive for the retail shareholders,” Investment advisor S.P. Tulsian said. “It is done to increase promoters’ shareholding. Grasim will again be seen as the holding company for financial services and hence will trade at holding company’s discount. The merged entity will be used to raise funds for debt-laden Idea Cellular to bid for upcoming spectrum auctions.”