Government should take measures to curb Chinese aluminium imports: Debnarayan Bhattacharya

10 February, 2016 | Business Standard

ShareBusiness Standard

10 February 2016

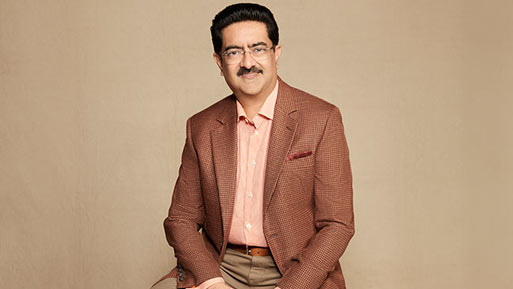

Debnarayan Bhattacharya, Managing Director at Aditya Birla Group company Hindalco Industries, is steering the company at a very difficult time. The company’s stock is down 52 per cent in the past year due to falling aluminium prices. In an interview, Bhattacharya tells Dev Chatterjee and Aditi Divekar about Hindalco’s measures to ramp up productions at its new plants to curtail cost of production. Edited excerpts:

How big a damage is cheap Chinese aluminium exports causing to the Indian market. What are the steps the industry is taking to tackle this?

There are almost 750,000 people who are directly or indirectly engaged in the aluminium industry in the domestic market. So, it is important that the government takes some measures to curb Chinese imports in the national interest. The Aluminium Association of India has, therefore, made representation to the government asking them to raise import duty on the metal to 15 per cent from five per cent at present. Currently, of the total domestic demand, about 50 per cent is being met by cheap imports from China, which is hurting domestic producers.

How do you see Hindalco Industries’ cost of production going ahead. Is there any room to lower it further?

There are several steps we are taking to keep our cost of production lower going ahead. Our ramp-ups at Mahan and Aditya aluminium smelters and Utkal refinery are going superb as efficiencies at each of these plants are hitting desired levels. Moreover, coal prices have come down globally and so there is some benefit towards power costs, although it could have been higher if the rupee was stronger. Given that Coal India is to increase its production, supply is expected to rise and hence we see energy costs coming down. Alongside, Hindalco has shut 42 per cent of capacity at the Hirakud plant since it was highly inefficient and could have been a cost burden.

What is your outlook on copper and aluminium businesses? Can you give an u;pdate on your capex plans for copper segment?

Treatment-and-refining charges have come down for 2016 compared to last year and this will have a negative impact on the copper business in the coming quarters. However, we are planning to go ahead with our capex in this business where we plan to set up a copper rod unit, which is a valueadded product. We are yet to arrive what the fund size would be for this plant. For aluminium, I think prices have bottomed out but cannot say how it would go from here. Premiums for aluminium, however, have seen marginal improvement.