Hindalco: building a global metals powerhouse

01 January, 2004 | Business Barons

ShareJai Shankar

South Asia’s leading non-ferrous metals company and a flagship of the Aditya Birla group, the Kumarmangalam Birla-led Rs. 4,976-crore Hindalco Industries Ltd. is set for high growth on the back of a booming domestic economy and firm aluminium prices worldwide. In an exclusive interview with Business Barons’ principal correspondent Jai Shankara, Hindalco Industries’ managing director Debu Bhattacharya outlines the company’s growth strategy.

The time is 7:00 p.m and most of the offices in south Mumbai’s busy business district near Churchgate are empty. But on the sixth floor in Industry House, the nerve-centre of India’s third-largest conglomerate, the Aditya Birla group, the lights are still on and Debu Bhattacharya is poring intensely over complex figures given to him by his subordinates. For him, home is still several hours away as he busies himself in fine-tuning strategies to transform Hindalco Industries Limited into a regional base metals powerhouse.

The time is 7:00 p.m and most of the offices in south Mumbai’s busy business district near Churchgate are empty. But on the sixth floor in Industry House, the nerve-centre of India’s third-largest conglomerate, the Aditya Birla group, the lights are still on and Debu Bhattacharya is poring intensely over complex figures given to him by his subordinates. For him, home is still several hours away as he busies himself in fine-tuning strategies to transform Hindalco Industries Limited into a regional base metals powerhouse.

As managing director of Hindalco, Mr. Bhattacharya exudes confidence about the future outlook of the aluminium industry in India and Hindalco in particular. The suave IIT-Kharagpur alumni, who also heads the group’s non-ferrous metals business, avers that with the global economy on an upswing the aluminium industry is all set to reap the rewards that come with a booming economy and the consequent surge in aluminium-consuming sectors such as housing and cars. He has now also set his eyes on foreign markets to make Hindalco a global metals player.

Besides Hindalco, Mr. Bhattacharya also spearheads the operations of other group companies — he holds the post of director-in-charge of Indal and the chairmanship of Utkal Alumina International Ltd. besides heading Birla Minerals Pty. Ltd. and the Mount Gordon Copper Mines in Australia. His knowledge of the industry and his ability to grasp the intricacies of business are outstanding. No wonder then that within a short time (he joined the Aditya Birla group in 1998) he has emerged as one of the key aides of Kumarmangalam Birla, the group’s dynamic 36-year-old chairman.

Apart from business, Mr. Bhattacharya is also active in industry fora and his views are assiduously sought by both the government and his peers. Presently he is a director on the panels of various apex industry organisations such as the prestigious The Fertiliser Association of India. He is member, Western Regional Council, CII, and member, Expert Committee of Agriculture and Agro-Industry of the Associated Chambers of Commerce and Industry of India, among others.

His track-record has latterly moved in only one direction — northward. Prior to joining the Aditya Birla group, Mr. Bhattacharya was a high-flier with Hindustan Lever Limited, joining its board of directors in 1991. He has also served on the boards of a number of its European subsidiaries, garnering valuable experience along the way.

In this exclusive interview with Business Barons’ principal correspondent Jai Shankara, Mr. Bhattacharya talks about the Indian and global aluminium industries and outlines his future plans for Hindalco. Excerpts:

In this exclusive interview with Business Barons’ principal correspondent Jai Shankara, Mr. Bhattacharya talks about the Indian and global aluminium industries and outlines his future plans for Hindalco. Excerpts:

How do you assess the current global environment in the aluminium industry? What impact will worldwide developments have on the Indian market?

Debu Bhattacharya: The overall outlook is positive. Two major economies — the US and Japan — have picked up recently and this augurs well for the future. The US economy, in particular, is moving forward briskly and Japan has registered encouraging growth in the last two quarters. More importantly, some vigour is also being witnessed in the Euro zone. All this will definitely have a rub-off effect on the aluminium industry which will benefit because of the pick-up in the global economy.

The Indian aluminium industry too stands to benefit because of these positive factors. In the past, the Indian market was insulated but post-globalisation this is no longer the case — global developments now leave their imprints on the Indian market as well. What is heartening is that the agricultural sector in India is likely to register healthy growth and this in turn is expected to bolster GDP growth by 6-7 per cent this fiscal. This is a significant jump when compared with the performance of the last few years. India has had a great monsoon this year. All this is very encouraging for the Indian economy. The upturn in the Indian economy will definitely perk up the domestic aluminium industry. Past experience has shown that the aluminium industry has always fared well when the overall economic climate is favourable and I am confident that this time too the aluminium industry will grow on the back of this overall economic resurgence.

Is Hindalco now on par with its global peers as a world-class aluminium major?

Bhattacharya: There are many dimensions to this, the first among them being size. On this parameter, I must admit we are nowhere near global players. But having said this, I must also point out one important change that has occurred in the global marketplace in the last few years. In the late-1990s, there were four or five mega-players. Now thanks to consolidation there are only two or three big players. The aluminium industry is following the same pattern that has emerged in the petroleum industry (Mobil and Exxon merger). As a result of consolidation, global players in aluminium are really huge today.

In India, aluminium companies are small and Hindalco, though it is the number one player in India, is still small in size when compared with global majors. But on the parameter of quality of business, I am proud to say that we are at the top along with the best of them. We enjoy a strong business structure which in turn bestows upon us an advantageous cost structure. Here I want to emphasise the fact that Hindalco ranks in the top quartile on this critical parameter of a low-cost structure. Besides, India possesses huge and high-quality bauxite deposits which China, for example, lacks. We leverage this advantage very effectively and our aluminium is, therefore, of a very high quality besides being LME-registered. This enables us to compete strongly in the international market.

With regard to technology, what is important is to have relevant technology which will not only ensure world-class quality but also a beneficial cost structure. Our people also possess all the relevant skill-sets. In fact, the Aditya Birla group possesses the best skill-sets across all its businesses, thereby making it a truly world-class conglomerate.

At Hindalco, three mantras are rigorously followed — to produce global quality products, enjoy a high degree of cost-competitiveness and possess a global reach. The last assumes tremendous importance in these days of intense competition. We have been continuously building up our capabilities to expand from the domestic to the international market so that our fortunes are not tied down to the destiny of one single country and market.

We have been successful in this strategy so far and I am confident this will fetch us rich rewards in the future as well.

How do you see prices moving on the LME? Do you feel that this trend of hardening prices will continue for some more time?

Bhattacharya: Prices are hovering sideways currently, at around $ 1,550 per tonne. The point to be noted here is that today base metals are not just guided by the demand-supply syndrome alone — they are being increasingly driven by technicals and fund play. These two factors are currently outperforming the fundamentals. I expect prices to hover in the range of $ 1,475-to-$ 1,525.

What impact, if any, will the prices on the LME have on the Indian market and on Hindalco in particular?

Bhattacharya: LME prices do get reflected here but only after a time lag. Domestic prices have now risen but much of this advantage has been neutralised because of the appreciation of the Indian rupee via-s-vis the US dollar. So while prices have gone up in dollar terms, they have not done so in any appreciable manner in rupee terms. We have factored these developments and revised our prices accordingly.

What factors will drive growth in the Indian aluminium industry in the coming years?

Bhattacharya: I will not be surprised if domestic demand increased by 6-7 per cent per annum in the next few years. This growth will be fuelled by increasing consumption from the automobile, transportation, packaging and power transmission sectors. The housing and construction industries are also in a growth mode and this will further increase the demand for aluminium. These sectors are projected to achieve high growth rates and hence I am upbeat about the outlook for the domestic aluminium industry.

Hindalco is one of the Aditya Birla group’s premier blue-chips. How do you perceive its future growth trajectory?

Bhattacharya: As you rightly mentioned, Hindalco is one of the Aditya Birla group’s premier blue-chips which has grown consistently since its inception. Today the company is in a unique position, commanding respect from its global peers who are far larger than us in size. Our strengths lie in the high-quality of our products and our ability to master and exploit available technology to the fullest.

Today, following Indal’s merger with us, we have a major presence in India. The acquisition of Indal represents a proud moment for us as it is one of the rare occasions when a MNC has been taken over by an Indian company.

Hindalco is mainly in the aluminium and copper businesses with a small presence in gold and silver. Hindalco is active in the entire integrated value chain — from mining to producing value-added products.

Another important facet of Hindalco which I want to highlight is its strong commitment to community development — we believe in being responsible corporate citizens and making a qualitative difference to the lives of the weaker sections of society who live in proximity to our plants. In fact, this facet is today a part and parcel of Hindalco’s ethos and makes the company an all-round corporate powerhouse, not just interested in making money but also in developing society.

How was Hindalco’s performance in FY 03? What, according to you, were the highlights during this period?

Bhattacharya: One must judge Hindalco’s performance in the backd;rop of the year when there was a significant d;rop in consumer spends. Despite this, Hindalco managed to sustain its performance with its turnover at Rs. 49.7 billion, operating profit at Rs. 12.1 billion and PAT at Rs. 5.8 billion. The year was also marked by a grid failure which affected production. However, we successfully overcame these problems and in my opinion, acquitted ourselves creditably.

An important highlight during this period was the successful amalgamation of the copper business. We also bought over a high-growth copper mine in Australia and hiked our stake in Indal. Thus, despite all odds and a none-too-conducive economic environment, we managed to post a healthy performance which clearly indicates the high resilience level of our company.

What is the outlook for Hindalco this fiscal (FY 04)?

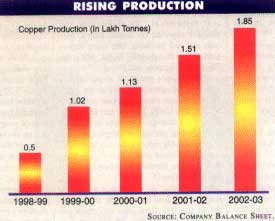

Bhattacharya: Our brownfield expansions are nearing completion. We have completed the process in aluminium and in copper, expansion is nearing completion. We will get some benefit from these expansions this fiscal but the full benefit of this will accrue to us next year. Our aluminium production capacity, presently at 3,45,000 tonnes per annum, will increase to 3,60,000 tonnes next year following the brownfield expansion while our copper production capacity will increase to 2.5 lakh tonnes per annum from the present 1.5 lakh tonnes. With the upturn in the economy and the present environment more conducive to growth, I am confident of bettering our performance this fiscal.

How do you see growth for Hindalco over the next three-year period? What factors will drive this growth?

Bhattacharya: The outlook is indeed bright and the following reasons will bear out my confidence. An important contributory to growth will be the results that will emanate from the conclusion of our brownfield expansions. The mines we have taken over (two in Australia) will be developed and we will get copper concentrates from them. We are already an integrated aluminium player; soon we will be an integrated copper complex as well.

We are already big into value-additions and we plan to strengthen our thrust further in this area. We expect our value-added products to further boost our turnover and profitability — in fact, value-added products will become a key driver of our earnings in the future.

We are also exploring branding possibilities for our products, especially the value-added ones. For example, we already have our Superwrap in aluminium foils and Everlast in aluminium sheets (the latter has proved very popular in Kerala). Our alloy wheels are sold under the brand name Aura. We now plan to brand our extrusion and roll products. Our aim is not just to sell metals but produce more downstream products. Accordingly, we are now in the midst of expanding our product range in value-added products.

What is Hindalco’s strategy to counter the increasing competition in the marketplace?

Bhattacharya: Our strategy is to enhance our topline growth through brownfield expansions which are naturally cheaper than greenfield ones. This bestows upon Hindalco an advantage in terms of volumes. Secondly, cost-consciousness is deeply embedded in our ethos which renders us highly-competitive not only in the domestic but also in the international market. Thirdly, our thrust on value-added products will help boost our bottomline.

It is true that margins are under pressure presently but then this phenomenon is not peculiar to the aluminium industry alone, it affects most industries. You must remember that when one is a major player like Hindalco, then one has to focus strongly on cost-consciousness. As one produces more, fixed costs come down. Growth always helps to contain costs.

When one is competing in the international arena, it must always be kept in mind that all players in the field are highly-efficient and cost-competitive. This is where Hindalco’s three mantras of global quality, cost-consciousness and global reach play a very critical role. Our strategy to counter competition is intertwined on the above three principles.

How much do exports contribute to the total revenues of Hindalco?

Bhattacharya: Exports contribute 21 per cent towards total revenues which we hope to increase to 25 per cent by FY 05. In volume terms, aluminium and copper exports constitute 18 per cent and 46 per cent respectively. In aluminium, the products exported are ingots, billets, wire rods and roll products. Our main export markets are Bangladesh, Dubai, Malaysia, Thailand, Singapore and Nepal.

The copper products exported are cathodes and continuous cast rods (cc rods). Here the main export markets are Saudi Arabia, the UAE, Taiwan and Malaysia. Our export strategy is to focus strongly on neighbouring markets as freight costs will be considerably reduced, thereby impacting our balance-sheet positively.

What are Hindalco’s future plans on the export front?

Bhattacharya: As production increases, our plan is to feed the domestic market and direct the overflow into international markets. This fits in perfectly with our strategy of achieving global reach. We have the capability to expand internationally as we have already shown.

Could you elaborate on your cost-cutting and efficiency-enhancing initiatives which you say have helped Hindalco boost its bottomline?

Bhattacharya: Hindalco derives its strength from its cost-consciousness. This has always been the bulwark of our competitiveness. As you are aware, we had initiated a profit-improving exercise called Rocket 2 K (2000) which helped us immensely. Recently (September 2003), we introduced a new ERP system to further enhance our cost-consciousness. Some costs are easily visible but there are some costs that are hidden in the sense that they are not easily detectable. This ERP system helps us in detecting, monitoring and controlling these costs. All things put together including our modernisation initiatives and brownfield expansions (a key cost-reduction driver), I estimate we have successfully brought down costs by nearly $ 50 per tonne.

How has increasing Hindalco’s stake in Indal from 74.6 per cent to 96 per cent helped your company in positioning itself along every link in the value-addition chain of the business?

Bhattacharya: Indal has been traditionally strong in the downstream business which is increasingly becoming Hindalco’s key business focus area. The acquisition of Indal therefore complemented our business strategy perfectly. Presently, the Hindalco-Indal combine enjoys a 60 per cent plus marketshare in the downstream business. Our think-tank has also identified other synergetic areas to work upon and we are presently giving shape to these plans.

Could you provide a brief background of Hindalco’s copper business?

Bhattacharya: We acquired our copper business in FY 03. It comprised of a new smelter which was commissioned only in 1999 and hence modern in all respects. It had a capacity of one lakh tonnes per annum which we de-bottlenecked to 1.5 lakh tonnes. Now, after our brownfield expansion is completed, capacity will be hiked to 2.5 lakh tonnes. We are moving rapidly in this business and presently copper contributes 52 per cent towards Hindalco’s total revenues.

How is the prevailing environment in the Indian copper market?

Bhattacharya: The copper market was marked by negative growth last year, the main reason being a shift in usage from jelly filled transmission cable (JFTC) to optical fibre. JFTC used to consume a tremendous amount of copper (nearly 60 per cent of cc rods) but once the change to optical fibre occurred, this entire market vapourised, thereby affecting the copper industry adversely.

However, I am happy to inform you that Hindalco’s think-tank had anticipated this change in market preference and had accordingly decided to concentrate on exports to make up for this shortfall. We, therefore, focused on international markets and hence we were not affected unduly by this market development. Presently, Hindalco holds pole position among copper players in India.

Is the Indian market adversely affected by increasing imports, especially from Sri Lanka?

Bhattacharya: Imports from Sri Lanka, if gone unchecked, could have posed a threat to the Indian copper industry, but the government recognised this threat on time and rectified it. Presently there is no problem on this count.

How are your plans to become a non-ferrous metals powerhouse progressing?

Bhattacharya: Our plans are in place. Our aim is to grow in size, increase our range of value-added products, c;reate brands and finally a brand equity for Hindalco in the copper business. We recognise the need for further cost-consciousness in this business if we have to conquer global markets.

We recognise that there can be no room for complacency as our competitors globally are also implementing the same strategy. However, I am confident our plans to be a major regional player in base metals will fructify within the next three-to-five years.

How is Hindalco’s precious metals refinery operations faring?

Bhattacharya: Let me first provide a brief background of this business. You see, copper is produced from copper ore which contains some quantities of both gold and silver. In most smelters, after copper is extracted, this goes into slime and thus gets wasted. We at Hindalco decided to put this gold and silver to good use.

We make seven tonnes of gold and around 45-50 tonnes of silver. Our turnover from this business is Rs. 250 crore. However, one must factor in fluctuations in prices of both these metals. Presently, gold is on a high and so realisations will be higher.

What are your future plans in these precious metals?

Bhattacharya: The answer is simple — as we increase our copper production, more gold and silver will be obtained. The market in India is huge for both these metals and selling our produce will be very easy. However, these are by-products; our core business will continue to remain aluminium and copper.

How do you assess the performance of Hindalco’s di-ammonium phosphate (DAP) business? What are your future plans here?

Bhattacharya: When copper is made, sulphuric acid is present.We convert this to phosphoric acid and since the Aditya Birla group has a huge presence in the fertiliser business, we decided to make di-ammonium phosphate (DAP). Hindalco is also present in the fertiliser business; our turnover from this business is Rs. 300 crore. Our future plans here hinge on our copper business; as the latter grows, so will our DAP business.

The acquisition of the Nifty mines in Australia is a feather in the cap of Hindalco. What was the cost of its acquisition and are there any other such acquisitions in the pipeline?

Bhattacharya: The Nifty mines was acquired in March 2003 for Australian $ 159 million. This mine is located in western Australia, about 1,300 kilometres from Perth. We acquired another mine — Mount Gordon — in east Australia (Queensland) in November 2003 for Australian $ 20 million.

Our strategy is to become a fully-integrated copper player with a wide array of value-added products. The acquisitions of these mines fitted in perfectly with this strategy. Besides, there were other favourable factors that influenced our decision to purchase these Australian mines. Normally, copper mines are found largely in Africa and south American countries like Chile and Argentina. But several parts of Africa are plagued by warfare and Chile and Argentina also have their share of military coups and revolts. Law and order is a prime requisite for the successful conduct of any business and hence we zeroed in on Australia where the rule of law is paramount. Besides, freight costs are also lower as compared to these countries.

How do you propose to fund your expansions, acquisitions, quality-enhancing initiatives, etc.? What is Hindalco’s debt:equity ratio presently?

Bhattacharya: Funding is the least of our worries — our cash flow is healthy and our liquidity position comfortable. In the past, both our organic and inorganic growths have been funded through our own cash flows and I see no exception to this in the future. We have an under-leveraged balance-sheet which we can leverage tellingly – very few corporates are in the same comfortable position as Hindalco in this respect. Our debt:equity ratio presently is 0.32 per cent.

Finally, what is your vision for Hindalco over the next five-year period?

Bhattacharya: Firstly, after our chairman Mr. Kumarmangalam Birla completed the re-structuring of the non-ferrous metals business by transferring the copper business from Indo Gulf to Hindalco, he elevated Hindalco to a non-ferrous metals powerhouse with global visibility. Secondly, consistent with our objectives of becoming, in our chairman's words, “a world-class globally competitive, integrated copper player with a presence along the entire value-chain”, we acquired two copper mines and made our foray into Australia. Now our ambition is to make Hindalco a regional non-ferrous metals powerhouse as a first step...