House of enterprise

20 August, 2007 | Outlook Business

SharePrashant Mahesh and M Anand

Outlook Business

20 August 2007

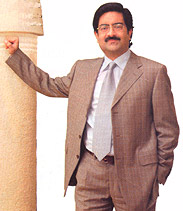

Kumar Mangalam Birla, the 40-year-old Chairman of the Aditya Birla Group, was born exactly 20 years after his great grandfather, Ghanshyamdas (GD) Birla, set up Gwalior Rayon (now Grasim Industries) in 1947. Eighteen years after that, his grandfather, Basant Kumar (BK) Birla set up Century Enka. And when his late father, Aditya Vikram Birla, set up his first overseas venture — Indo-Thai Synthetics — in 1969, Kumar Mangalam was just two.

In the late '70s, Kumar Mangalam was witness to a rare phenomenon in business history — three generations of the Birla family were running their own independent and flourishing businesses. "I have had the advantage of seeing the three stalwarts," says Kumar Mangalam Birla, now the chairman of the $24-billion Aditya Birla Group. "It's like I've been in a management school since I was 15 or 16," he adds.

In the late '70s, Kumar Mangalam was witness to a rare phenomenon in business history — three generations of the Birla family were running their own independent and flourishing businesses. "I have had the advantage of seeing the three stalwarts," says Kumar Mangalam Birla, now the chairman of the $24-billion Aditya Birla Group. "It's like I've been in a management school since I was 15 or 16," he adds.

The '70s was a golden era for the Birlas. GD Birla, though he had crossed 80 by then, was still at the helm of Hindalco and Grasim.

BK Birla had established his own group of companies. Though his companies did not match GD Birla's in size or fame, BK Birlas' Century twins — Century Textiles and Century Enka — were rapidly becoming significant profit and growth centres. AV Birla, still only in his 30s, had by then established his own fledgling business empire in Thailand, Indonesia, the Philippines and Malaysia. This trait defines the character of the Birlas — every successive generation that inherited businesses from their parents also started own companies.

Testing new waters

Under Kumar Mangalam, the group entered new segments like business process outsourcing (BPO), in which Transworks-Minacs is the third largest third-party BPO outfit in the country, and Idea Cellular, market capitalisation of which is over $8 billion, accounts now for almost a third of the group market cap.

Similarly, if AV Birla was path-breaking in his expansion into South-East Asia, Kumar Mangalam has given the entire group a truly global shade. Half of the group's revenues now come from overseas. The $6-billion acquisition of Canadian aluminum rolled product giant Novelis has been Birla's biggest statement so far. "The seed was planted by my father. He was the first to make significant investments in the overseas markets," says Kumar Mangalam. "This has given us the courage to do some of our recent big acquisitions," he adds.

A new policy

Unlike his three predecessors, Kumar Mangalam started off with a disadvantage. He was thrust into the hot seat very early in his career, when his father passed away in 1995. AV Birla inherited GD's legacy when he was 40 but Kumar Mangalam had to take over from his father when he was 28. The initial years were not easy. But in the last 12 years, he has transformed the group in terms of size, profitability and character. Very early on, he brought in several key managers, including Debu Bhattacharya (now Hindalco's Managing Director), Santrupt Misra (the group's human resource and IT chief), Sumant Sinha (he heads the retail business), Sanjeev Aga (Managing Director of Idea Cellular). "We went in for lateral induction from outside the group," recalls Kumar Mangalam. "Now we have a more diverse basket of skills in the organisation, much more than what we had before," he adds. At that time, the group did not have a retirement policy. Kumar Mangalam introduced one and over 350 managers above 60 retired.

All this was a departure from the management style of the Birla family till then. Earlier, whenever the Birlas set up a new project they would promote senior people from within the organisation. However, Kumar Mangalam broke away from this tradition, since he had to expand at a fast pace. "In terms of management style, the change from GD Birla to me was 10 per cent; from me to Aditya was 25 per cent. But from Aditya to Kumar Managalam it was 75 per cent," says BK Birla, 87. "The transition that Kumar Mangalam has brought into the group is amazing. In terms of distance covered, he has achieved more than the other groups," says a senior consultant.

All this was a departure from the management style of the Birla family till then. Earlier, whenever the Birlas set up a new project they would promote senior people from within the organisation. However, Kumar Mangalam broke away from this tradition, since he had to expand at a fast pace. "In terms of management style, the change from GD Birla to me was 10 per cent; from me to Aditya was 25 per cent. But from Aditya to Kumar Managalam it was 75 per cent," says BK Birla, 87. "The transition that Kumar Mangalam has brought into the group is amazing. In terms of distance covered, he has achieved more than the other groups," says a senior consultant.

Kumar Mangalam also brought in some structure into the group's diverse business. He structured the group into two broad baskets — value and growth. "The value businesses are cash cows and do not require much investment. Our strategy is to invest from the value businesses into the growth business," he says. "That is a natural sort of a transition and that is the general construct of the group," he adds. This overarching philosophy led to several reorganisation exercises, foremost among them is the formation of Aditya Birla Nuvo, the vehicle for the group's many new businesses. Seven years into the new century, it could be said that Kumar Mangalam has put into the group the same sense of purpose and urgency with which GD Birla built the group in the beginning of the twentieth century.

In the beginning, the GD Birla Group, that has its roots in Pilani, Rajasthan, grew primarily through trading (primarily jute) across Mumbai and Calcutta. GD Birla's brothers ran their own independent businesses, but the GD Birla family clearly established itself as the fastest growing branch. In 1918, GD Birla established Birla Brothers &Co to trade in jute.He was dissatisfied with trading and realised that real profits lay in manufacturing, something that the British would not allow. With difficulty he entered jute mill manufacturing in 1919. Two years later, GD Birla founded Jiyajeerao Cotton Mills in partnership with the Maharajah of Gwalior, thus beginning the era of manufacturing for the group.

Global bend

Global bend

Post-Independence, GD Birla was counted among the top industrialists. Though the Tata Group was founded much earlier, GD Birla substantially bridged the gap. He ran Grasim and Hindalco (started in 1958) with much independence, still, bureaucratic issues and a socialist government did not help GD expand much. "The period from 1950 to 1990 was difficult for India," says BK Birla. Meanwhile, in the '50s BK had begun to get his empire underway. He forayed into aviation by starting Bharat Aviation. After some teething troubles the business did turn profitable, but eventually the government snatched it from him for a pittance in a massive wave of nationalisation.

Even as GD Birla and BK Birla ran their businesses separately, the former began to take a keen interest in Aditya Birla. It became increasingly apparent that GD Birla's empire would pass on to his grandson. In September 1962, Aditya went to Boston to get a degree in chemical engineering. GD and Aditya enjoyed a close relationship. Often they discussed business in the many letters they exchanged.

Even as GD Birla and BK Birla ran their businesses separately, the former began to take a keen interest in Aditya Birla. It became increasingly apparent that GD Birla's empire would pass on to his grandson. In September 1962, Aditya went to Boston to get a degree in chemical engineering. GD and Aditya enjoyed a close relationship. Often they discussed business in the many letters they exchanged.

Even while he was studying, in 1964, Aditya got a taste of what foreign alliances were when he conducted negotiations in America with DuPont for a ,joint venture in India, recounts Minhaz Merchant in his biography of Aditya Birla. However, the Birlas opted but, as DuPont demanded a higher equity stake in the venture.

But when Aditya returned to India, he chose to start out on his own. Though GD offered him a seat on the board of Hindalco, Aditya declined, recounts Merchant in his book. Yet another generation of the Birlas had chosen entrepreneurship over inheriting the family business.

Aditya started off with Eastern Spinning Mills in Calcutta in 1965. However, the big opportunity and learning for Aditya came next year, when he took over Indian Rayon, a sick company bundled with production and labour problems, for Rs. 30 lakh from the Morarjee Vaidya family. Workers went on a flash strike and there was a fire in the plant. But he turned the company around.

The Indian economic environment in the '60s did not provide enough opportunities to meet Aditya's entrepreneurial fervour. That prompted him to set up businesses abroad. "Bangkok was in Asia. Travel was easy. There were a lot of Indians there and the Thai government was cooperative. So Aditya expanded there," recalls BK Birla. He expanded vigorously in Thailand and Malaysia. By 1994, he was Thailand's largest exporter of synthetic yarn, Asia's largest producer of acrylic fibre and the world's largest producer of rayon fibre.

|

Birla — Inherited and entrepreneurial | ||

| companies inherited | companies started/acqiured | |

| Ghanshyamdas Birla | Trading business | Hindalco, Grasim, Hindustan Gas |

| Basant Kumar Birla | No major company | Century, Kesoram, Jayashree Tea, Bharat Airways, Hindustan Gas, Mangalam Cement |

| Aditya Vikram Birla | Hindalco, Grasim, Hindustan Gas | Indo Gulf, Indian Rayon, MRPL, overseas business in South east Asia, Eastern Spinning |

| Kumar Mangalam Birla | Hindalco, Grasim, Indian Rayon | Retail venture, Idea Cellular, UltraTech cement, TransWorks, Aditya Birla Minerals, Birla Sunlife Insurance and asset management |

Cementing the future

In 1983, when GD Birla passed away, Aditya inherited many of his companies, including Hindalco and Grasim. Aditya was only 40 then, but still commanded the respect of the managers of his grandfather's era, thanks to his overseas success.

By 1994, the last full year of Aditya Birla's life, it had manufacturing operations in five countries — Thailand, Egypt, Malaysia, Indonesia and the Philippines. In VSF, the group was the world's largest producer. In Malaysia, his Pan Century Edible Oils was the world's largest. From 1969, when Aditya's first overseas venture was set up in Thailand, to October 1995, the global revenues of his companies nearly equalled that of its Indian operations. In that sense, it could be said that what GD Birla c;reated in India, Aditya Birla equalled in South-East Asia.

Aditya was equally adept at handling the companies he had inherited from his grandfather. Take Hindalco after Aditya took over, its net profit increased from Rs. 2.43 crore to Rs. 401.15 crore by 1995-96. In 1990, Hindalco was the first company to raise capital at a premium of Rs. 100 per share. Subsequently, it raised $100 million and $108 million through two Euro issues. Similarly, in Grasim, he tackled the viscose dumping problems. He lobbied with the government against the import policy and simultaneously diversified Grasim's product range. Cement was given emphasis and would in future become a significant profit centre. By 1988, Grasim was the world's second largest producer of viscose staple fibre.

Though most of his trusted aides were from the Marwari community, Aditya gave complete freedom to his chief Executive officers. "My father was a great incubator of talent," recalls Kumar Mangalam. Perhaps the best talent that Aditya ever incubated was Kumar Mangalam himself. Aditya groomed Kumar, just like he was groomed by GD Birla. Aditya started involving Kumar in the family business when he was in college. As a college student, Kumar would hang around his father's office watching him at work. When Kumar Mangalam returned from London with an MBA, he was sent to Hindalco's Renukoot plant in UP for a brief stint. After his MBA, Kumar regularly sat with Aditya in his meetings with his key Executives. Before Aditya's demise, Kumar Mangalam was independently handling Grasim's cement division, the fertiliser business of Indo Gulf, and also a newly setup carbon black unit in Egypt. Though the media was not aware of Aditya having cancer, in the last two years he set about teaching everything he knew about running a business to Kumar.

Aditya started involving Kumar in the family business when he was in college. As a college student, Kumar would hang around his father's office watching him at work. When Kumar Mangalam returned from London with an MBA, he was sent to Hindalco's Renukoot plant in UP for a brief stint. After his MBA, Kumar regularly sat with Aditya in his meetings with his key Executives. Before Aditya's demise, Kumar Mangalam was independently handling Grasim's cement division, the fertiliser business of Indo Gulf, and also a newly setup carbon black unit in Egypt. Though the media was not aware of Aditya having cancer, in the last two years he set about teaching everything he knew about running a business to Kumar.

Among the many lessons he learnt, Kumar Mangalam has perhaps benefited the most from his father's visionary approach to globalisation. "Globalisation is a way of life. We will see much more global character coming forth in the next few years. This is the natural growth trajectory for our businesses," he concludes.

|

Milestones | |

| 1857 | Seth Shiv Narayan Birla laid foundation of Birla Group |

| 1947 | Grasim incorporated. Group into jute business, started by GD Birla, for 28 years |

| 1958 | Hindalco incorporated |

| 1962 | Hindalco commenced production at Renukoot, UP |

| 1965 | Aditya Birla started Eastern Spinning Mills and Industries |

| 1966 | Indian Rayon acquired |

| 1969 | Group's first overseas company, Indo-Thai Synthetics, set up |

| 1985 | Indo Gulf Fertilisers went on stream in Uttar Pradesh |

| 1986 | Birla Growth Fund set up |

| 1988 | MRPL, a JV with HPCL, set up |

| 1990 | Kumar Mangalam got actively involved in the Group's operations |

| 1995 | A JV with AT&;T formed |

| 2001 | Grasim acquired over 10 per cent in L&;T. Indian Rayon picked up a stake in PSI Data Systems |

| 2003 | Indian Rayon bought TransWorks. Birla Copper acquired Nifty Copper |

| 2007 | Novelis now Hindalco arm. Hindalco now largest aluminium company |