Mr. K. C. Birla and Mr. Sushil Agarwal recognised at Business Today's Best CFO Awards

10 June, 2013 | Business Today

ShareBusiness Today

June 2013

Now, in its fourth year, the Business Today Best CFO Awards has c;reated a legacy of success, and reached an aspirational level. The award recognises the people who have perhaps the most difficult job in corporate India — heading the finance department — especially at a time when the economy is struggling, and companies are struggling even more. They have to keep a hawk's eye on the top line, bottom line, shareholder returns, market value, debt levels, and so on. And they are also responsible for their companies' continued financial well-being and future strategies to tackle unanticipated changes in the environment. Which CFOs managed this complex role best? And how did they do it?

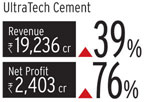

Mr. K.C. Birla, CFO, UltraTech Cement

Winner, India’s Best CFO, in the category of Remarkable Leverage Management (Large): A Business Today-Yes Bank survey

The Aditya Birla Group is known for financial prudence. Leverage management at UltraTech is part of the core strategy without in any way compromising growth and business leadership. The foundation of our leverage strategy is to have an efficient capital structure suitable for our industry and to maintain a leadership position. We c;reate efficiency by s;elective and strategic implementation of projects supported by thoughtful leverage.

The Aditya Birla Group is known for financial prudence. Leverage management at UltraTech is part of the core strategy without in any way compromising growth and business leadership. The foundation of our leverage strategy is to have an efficient capital structure suitable for our industry and to maintain a leadership position. We c;reate efficiency by s;elective and strategic implementation of projects supported by thoughtful leverage.

Our chairman's philosophy of 'Last man standing, first man forward' is our DNA. So, we work in a way that renders our cost structure very efficient. Consequently, during the downtrend in the economy, we are the last man standing. When the growth cycle starts, our better leverage and cost efficiency enables us to be the first man forward.

We decide leverage based on capital structure, debt servicing and investor requirement, and then arrive at an optimum ratio. One of the cornerstones of our strategy is to maintain the top credit rating for both long-term and short-term debt to ensure that we attract the best proposals from lending agencies at fine pricing levels. Our leverage strategy is applicable not only to borrowings but encompasses treasury, working capital management, including inventory and receivable as well as project management.

Once we decide the quantum of borrowing, based on a number of factors, we opt between rupee or overseas borrowing or international bonds. While we evaluate foreign currency borrowing, we consider the fully hedged cost for decision making. This approach eliminates foreign-exchange losses as is the case with many Indian companies.

Once we decide the quantum of borrowing, based on a number of factors, we opt between rupee or overseas borrowing or international bonds. While we evaluate foreign currency borrowing, we consider the fully hedged cost for decision making. This approach eliminates foreign-exchange losses as is the case with many Indian companies.

Let me drive home two examples of leverage management. First, on an acquisition: ETA Star Cement (Middle East) was acquired using a mix of internal accruals and debt. We have opted for higher leverage for acquiring ETA Star due to a significantly lower interest cost and existence of natural hedge. Debt was largely through international borrowing.

Second, treasury management: We maintain appropriate treasury levels and earn competitive returns. Our treasury returns are among the best in the industry. Our treasury also helps us defer borrowing when interest rates are not in our target range.

As a result of such a strategy our average cost of long-term borrowings has been below 8.5 per cent while short-term borrowings have been at less than eight per cent. The company's debt-to-equity ratio on a consolidated basis is 0.48 while the ratio is 0.17 net of treasury.

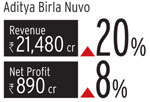

Mr. Sushil Agarwal, CFO, Aditya Birla Nuvo

Winner, India’s Best CFO, in the category of Enhancing Competitiveness through M&;A: A Business Today-Yes Bank survey

Mergers and acquisitions have been an integral part of Aditya Birla Nuvo's growth. The company traces its origin to a modest beginning with the acquisition of Indian Rayon Corporation in 1963. A decade later, the textiles and insulators businesses were merged with the company.

Mergers and acquisitions have been an integral part of Aditya Birla Nuvo's growth. The company traces its origin to a modest beginning with the acquisition of Indian Rayon Corporation in 1963. A decade later, the textiles and insulators businesses were merged with the company.

The company has built many of its key businesses from scratch, such as life insurance and non-banking finance. However, mergers and acquisitions have played a key role in the company's transformational journey from a manufacturing company in the late nineties to a $4.5 billion conglomerate today. For instance, the acquisition of Madura Garments in 2000 spawned India's largest premium branded apparel player. The acquisition of Apple and Alliance mutual fund schemes strengthened the leadership position of Birla Sun Life Asset Management. From being a regional player, Idea Cellular emerged as one of the leading national players, aided by acquisitions including that of Spice Communications in 2008.

In line with the company's vision, the underlying strategy of every merger or acquisition has always been to acquire an established platform in a promising sector, followed by capturing growth potential, deriving synergies and achieving leadership position.

Two of our recent acquisitions are worth mentioning — those of Columbian Chemicals and a controlling stake in Pantaloons Fashion.The acquisition of Columbian Chemicals by Aditya Birla Group was not only aimed at becoming the world's largest carbon black player but also to derive synergistic benefits in logistics, sourcing and technology.

Two of our recent acquisitions are worth mentioning — those of Columbian Chemicals and a controlling stake in Pantaloons Fashion.The acquisition of Columbian Chemicals by Aditya Birla Group was not only aimed at becoming the world's largest carbon black player but also to derive synergistic benefits in logistics, sourcing and technology.

The acquisition of a controlling stake in Pantaloons Fashion by Aditya Birla Nuvo was also in line with our goal to be at the top of the league. It not only extends our footprint into the fast-growing fashion segment but also strengthens our presence in the women’s wear and kids wear segments. The transaction took around 12 months to complete, considering the complexities involved. The carving of Pantaloons Fashion as a separate business unit out of its listed parent was a challenge. The structuring of the transaction to get a controlling stake was also a milestone.

The acquisition provides an established, popular and fast-growing 'Pantaloons' platform, with a prominent hold in eight urban and 23 other cities of India. The customer reach of our retail channel stands expanded to more than 1,300 exclusive brand outlets spanning four million square feet. Pantaloons enjoys the first-mover advantage in several locations across eastern India. This strengthens our geographical presence. Additionally, the acquisition will result in synergies in terms of raw material sourcing, rentals and so on. These benefits will accrue gradually.

Today, each of our businesses, whether grown organically or inorganically, has attained market leadership - led by our continuous thrust and investment in enhancing competitiveness even during tough times. This is evident from the fact that most of our businesses have been consistently outperforming the industry and its peers.