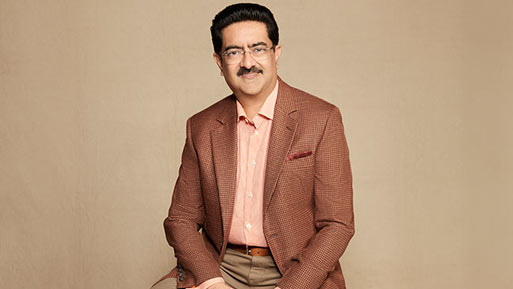

Binani cement bidding process lacks transparency: UltraTech MD

22 March, 2018 | Business Line

ShareUltraTech Cement, the country’s largest cement company, is in a pitched battle against Dalmia Bharat Cement to acquire the 10-million-tonne of stressed Binani Cement asset. UltraTech surprised the market first by increasing its bid by ₹700 crore to ₹7,266 crore at the eleventh hour and followed it up by signing a deal with Binani Cement to buyout the asset out-of-court. KK Maheshwari, Managing Director, UltraTech Cement, spoke to BusinessLine on the developments and way ahead. Excerpts:

Why did you raise the bid so late?

When the bidding process started we were told that we would be called for negotiations if we were s;elected. So we kept the best for last. We would have anyway increased the bid if they had called for negotiations as promised earlier. It is strange that creditors are rejecting a bid which is offering maximum value. We followed the principal of fair and equitable treatment, while bidding and gave equal weightage to all unsecured creditors rather than favouring large secured creditors who have the voting rights. We did not focus on catering the vote bank. We offered to pay entire dues to 98 per cent of small trade creditors as they suffer the most.

Is there a precedence of this sort?

This whole IBC is a new thing. However, there is precedence under the other law. Suppose someone mortgage their property and it comes to auction due to default, the owner of the property has the right to accept a higher bid out of the auction process, but before the auction deal is ratified by the Court. The entire process is one of the mechanisms to recover maximum money. There is already a Sarfaesi Act (Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act) then why will they come out with IBC. Whatever mechanism you follow, the Court has to look at the interest of every creditor and not only that of banks.

Why deal with Binani directly? Have you lost faith in NCLT?

Absolutely not. We have full faith in NCLT that is exactly why we filed our revised offer with NCLT after our bid was rejected. Despite our revised higher bid, the resolution professional has decided to go with Dalmias. That’s when Binani approached us asking whether we can do a bilateral deal with them on the same terms and conditions like that of NCLT. We said if they can take the company out of NCLT we can do it. Obviously they will be affected because it is their asset which is on the block.

What if NCLT orders a rebidding?

Let us see. I cannot prejudge what NCLT will do. The entire Insolvency and Bankruptcy Code was formed to extract maximum value for the stressed asset. Whether the maximum value is derived through the court process or outside it should not matter unless the debt is paid off fully. The Court can also reject the entire process if Binani wants to withdraw from NCLT and pay off the entire debt.

Is it proper to hike the bid after knowing the other bidders’ amount?

There is no transparency in this bidding process. The financial and technical bid will work only if the process is pre-defined. They should have defined how different creditors will be treated and given their outstanding amount. The scoring process needs to be defined properly. The RP reduced our marks just because there was a CCI litigation. They have also not considered the fact that we have received CCI approval for three takeovers even after the ongoing litigation. This beats logic. Reducing our marks on CCI issue was unwarranted. We have written half-a-dozen letter and they have not responded even once.

Do you think this case will reach the Supreme Court?

I really do not know. It is a clear open-and-shut case. They have two offers in front and s;elect the highest bidder. If people do not get fair treatment, the Apex court is the last resort. It is a Binani Cement asset and bankers had taken it to NCLT to recover money. Now the company is saying take the money and give the asset back. It is as simple as that.

Will consolidation in the industry lead to monopoly?

The cement industry is highly capital-intensive and has long gestation period. There can be some mismatch in demand and supply for various reasons. In the last four decades of our existence, we expanded capacity irrespective of mismatch in demand-supply. Even if we get Binani, there are other large players in Rajasthan like Shree Cement, LafargeHolcim, Wonder Cement, JK Lakshmi Cement and JK Cement. All these companies have taken new mining licence for expansion. With this intense competition, it is difficult to even command 18-25 per cent market share as there are six large companies breathing down the neck. It is a fragmented industry and nobody can even think of monopolistic power.